Kim H. Esbensena and D. Aldwin Vogelb

aKHEConsulting, Copenhagen, Denmark. E-mail: [email protected]

bAlfred H. Knight International Ltd, Raamsdonksveer, Netherlands [email protected]

DOI: https://doi.org/10.1255/sew.2023.a2

© 2023 The Authors

Published under a Creative Commons BY licence

The Assay Exchange paradigm is an integral element in many contractual agreements stipulating how business transactions rely on comparison of two independent assay results for commercial trading purposes. It turns out that the current Assay Exchange vs splitting gap comparison paradigm incurs no less than two unrecognised sampling uncertainties, which leads to hidden adverse economic consequences at least for one—and sometimes for both contractual parties. The magnitude of this unnecessary uncertainty is never estimated, which leaves management without information about potential economic losses, a breach of due diligence. However, all that is needed to resolve this critical issue is stringent adherence to the Theory of Sampling (TOS) by mandatory contractual stipulations of only accepting representative sampling and sub-sampling principles.

Introduction: definitions

To appreciate the most general application of the findings described below, let’s define a technical “black box” (BB) as an element in a business process. A BB connects product exchanges between a buyer and a seller, or the BB constitutes a comparison platform for analytical results from two or more analytical laboratories; a special manifestation of a BB would be as a depository for goods awaiting quality checks by one or both trading parties. The topic treated here is typically surfacing within the realm of, e.g., mining and metal refining, TIC company operations (Testing, Inspection, Certification), shipping agents, traders, regulating bodies, banks, financiers, investors etc.

In the treatment below a few definitions and synonyms are needed:

- Seller/depositor/supplier/laboratory 1

- Buyer/customer/laboratory 2

- Umpire (mutually agreed upon authoritative “third party” analytical laboratory)

Reasons behind the “assay exchange” paradigm

For the present discussion, let the focus be on trading involving metal concentrates, or a depositor delivering a consignment to a refining facility with the aim of refining various precious metals. There is always a need for fast accounting in commercial trading, or, in the second example, since the physical–chemical refining process operates on a much longer time scale than the desired business closure; the speed and, of course, reliability of the business accounting is of the essence.

The seller’s assay results recorded on the suppliers’ waybills are the input documentation relied upon for capturing the physical movement of materials into the “black box” (documentation shall ideally reflect the depositors’ materials type in extenso, i.e. content, weight and assays of the precious metals involved; sometimes also “deleterious metals” diluting the valuable metal grades).

However, the depositors’ assays are generally not relied upon by contractual parties for the purposes of securing reliable output documentation accompanying the movement of processed metals out of the BB facility. In such cases, the sampling procedures used for providing the material for analysis is contractually the responsibility of both transaction parties individually. This means that all contractual documentation, comparison and/or reconciliation objectives are exclusively based on the resulting analytical results from the two parties, each interested in optimising their own prospect in the commercial transaction. The assay exchange paradigm is designed to resolve the closing business settlement issues and interests on a fair and equal basis.

Black Box (BB)

Facility either processing incoming material (“active BB”) or used as a passive facility recognised by both parties in a contractual trade relationship (“storage BB”). The objective of an active BB can, for example, be refining of precious metals, or it could be a mutually accepted secure depository holding a consignment until a later date, related to commodity trading (e.g. hedging ). In general, a BB facilitates product exchanges between a buyer and a seller, or it can further split-sample exchanges between two analytical laboratories. Incoming material to a processing BB will be assayed either by the depositor (the seller), the BB facilitator or by a third-party agent appointed and approved by both contractual parties, producing “ingoing analytical information”. When leaving the BB, processed, or end-of-storage material, will be independently assayed (outgoing analytical documentation), either by the opposing trading party (the buyer), or a third party (the “umpire”). The determining feature of a business transaction is the “assay exchange” paradigm, which is the standard agreement facility with which to close business.

MvG (Mismatch vs Gap) risk: Difference between assay values from two opposing parties, compared to the magnitude of a contractually agreed upon maximum “splitting gap”. The absolute assay difference is compared to a mutually agreed splitting gap range, regardless of the general level of the average gap concentration level, which leaves analytical accuracy stranded as a victim of economic expediency—to be explained.

Official definitions

The MINEHUB website describes the assay exchange process for the commodity concentrates (accessed 18 December 2022):

“Concentrates are finely ground materials (with waste rock removed) containing metals and minerals from mine sites such as copper, nickel, lead, zinc. The value of the concentrate is defined by the composition and prices of the individual elements that make up the concentrate. Every time the concentrate changes hands or custody, the buyer and seller rely on laboratory tests called assays to verify the metals composition. The assay exchange process is an iterative process in which the buyer and seller compare their respective assays and sometimes require umpire arbiters to ultimately agree on the chemical specification of the concentrate that is being transacted, and therefore the final price the buyer must pay the seller.”

Function of the “assay exchange” paradigm

In commercial practice, an agreed assay is determined between a seller and its customer via a financial negotiation. The agreed assay is referred to as the “settlement assay” and the process of negotiation is referred to as an “assay exchange”. The negotiation basis typically used is age-old and have remained effective and unchallenged for long. A short initiation is as follows:

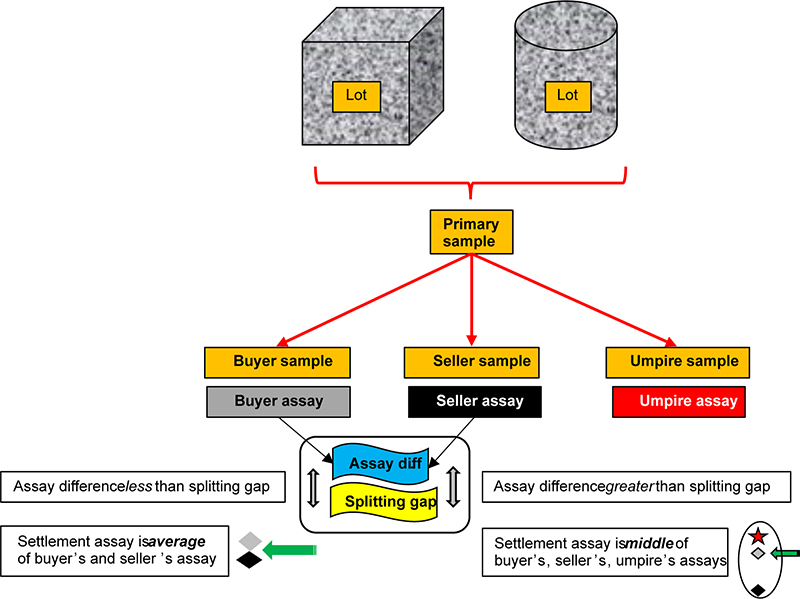

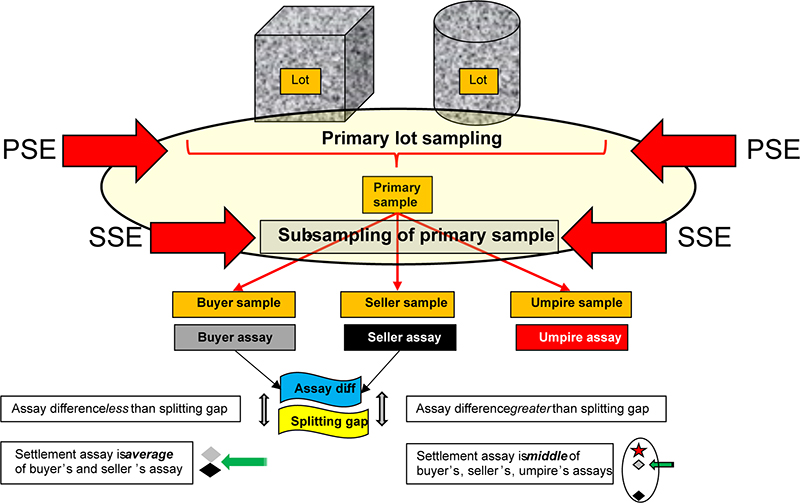

- “A primary sample of the lot in question is split into three sub-samples intended for i) buyer, ii) seller and iii) umpire”.

- Both parties (seller and buyer) simultaneously advise the other of its assay result.

- Either party is obliged to use the assay determinations produced by their respective laboratories [the parties can in fact submit any assay result they may desire, but there is an in-built near certainty for a heavy punishment for a(ny) party wishing to tip the scales unilaterally hopefully in its own favour, see below re “payment to umpire”].

- If the two assays exchanged fall within a contractually specified range, “the splitting gap”, the mean of the two assays becomes the settlement assay—end of business settlement: the accounting department makes the necessary multiplications of tonnages, concentrations × unit prices etc.

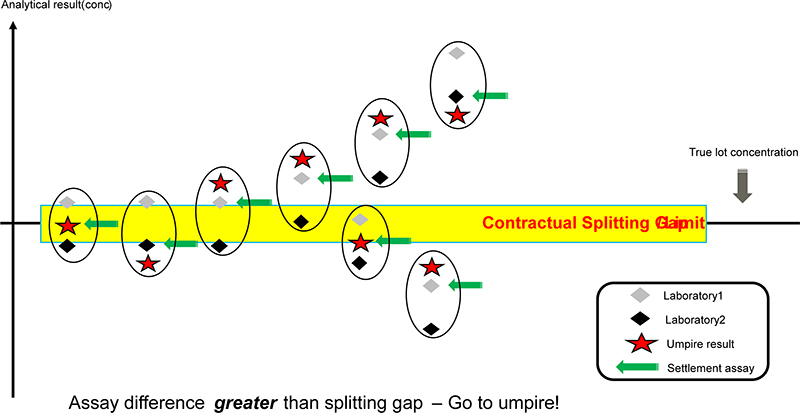

- But if the difference between the two assays is greater than the “splitting gap”, an independent third-party umpire shall arbitrate, helping to determine a settlement assay in accordance with the contractually agreed procedure. Variants of the details of this latter part of the paradigm exist, but the basic principle of a splitting gap determinant remains. This process is referred to as “going to umpire”.

- Details: The difference between the two reported assays is compared to the contractually agreed maximum “splitting gap”. If the difference between the reported assays is lower than this threshold, the average of the two assays becomes the Settlement Assay. If the difference is greater, the business paradigm dictates that the third sub-sample of the primary sample is assayed by the Umpire laboratory (this sample has been kept in secure storage until it was decided whether to include it in the assay exchange scheme or not). In this case, the middle of the three assays becomes the Settlement Assay.

N.B. Whichever party is farthest away from the umpire’s result pays the umpire’s analysis fee, which is always (very) expensive (this is the potential punishment indicated above for trying to skew data without factual evidence). Following the conventional scheme, gains and losses to the buyer and seller will be the monetary value of the difference between the settlement assay and their respective own assays, adjusted for umpire fees for the “loosing party”.

The fixed assay exchange scheme is designed to determine a settlement assay with ease, clarity and speed under the tacit assumption that the settlement assay will always lie close to a target lot’s “true” metal content and that all analytical differences are exclusively a result of relative analytical ability. This assumption is incorporated in Figures 1 and 2; while Figures 5–9 portray the more realistic assay exchange setup, explicitly acknowledging a sampling-before-analysis variance that will always also be present. This case is explained in full detail below.

Figure 1. Conventional Assay Exchange Paradigm: focus is exclusively on relative analytical reliability.

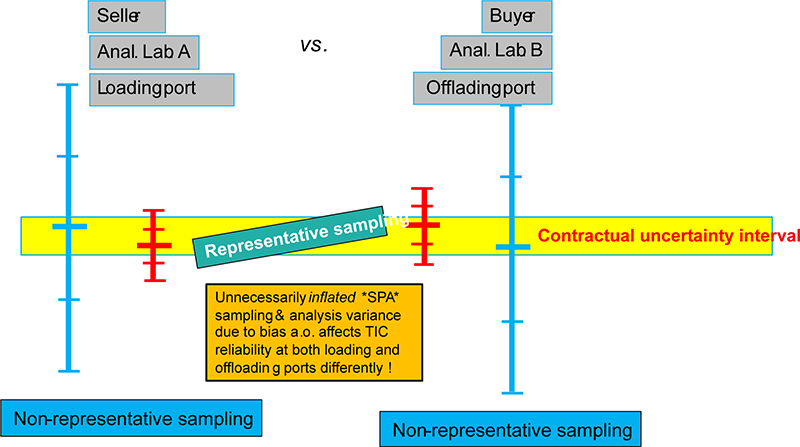

Figure 2. Two-party dilemma. Non-representative sampling compromises assay results independently at the loading and discharge ports. Compromised sampling performance will always result in larger-than-necessary uncertainties (blue: avr. ±2 std)

While in the real world the two-party setup has many manifestations, e.g. buyer vs seller, loading port vs discharge port sampling, analytical lab A vs analytical lab B (Figure 2) the principal issue is identical, a determining assay exchange. In the following, the example of sampling and certification at two ports (seller’s loading port vs buyer’s discharging port) is used.

The focusing issue is that non-representative sampling impacts independently at the two ports. Potential biased sampling, as well as other sampling deficiencies, if/when present, will unavoidably result in significant, increased uncertainties (blue: avr. ±2 std). The point here is that the magnitudes of these inflated sampling-plus-analysis variances are never known within the conventional paradigm—rather they are ignored.

An elephant in the room

Thus, the adverse impact from inferior sampling is not included in the conventional assay exchange paradigm; there are simply no sampling stipulations associated with the mandate: “the primary sample is divided into three sub-samples” intended for the seller, the buyer and the umpire, Figure 1. Rather, since assay exchanges are financial negotiations, generally they are business compromises, under adverse sampling conditions this procedure can in fact produce a settlement assay significantly different from the actual (“true”) metal content in the lot. This is here termed the mismatch vs gap error (MvG), to be exposed in full.

The Theory of Sampling (TOS) interlude: all materials in the realm of technology, industry, processing, trading, commerce … for which Testing, Inspection and Certification (TIC) is on the agenda, are heterogeneous—it is only a matter of degree. The Theory of Sampling (TOS) has for over 70 years proved the severe danger involved in assuming that there is no sampling error involved in extracting the primary sample—but this is not the place to detail the TOS. There is ample background literature available, e.g. References 1–6.

While the MvG is an acknowledged risk for/by both parties, in the interest of a quick business resolution, most parties are usually eager to get to the settlement assay, accepting the MvG (knowingly or unrecognised) without further ado, to get the payment for goods delivered effected as fast as possible. This status quo is presumably a reflection that both parties consider this a symmetrical risk, not worth elaborating much upon for every single transaction in view of the magnitude of day-to-day business economics: sometimes the seller (trader, depositor …) could perhaps be shown to be marginally over-paid (the BB facility pays a bit too much for a marginally overestimated material grade)—but in the long run this is considered levelled out by the opposite possibility in which the buyer (or the refined deposited allotment collector) is actually being paid marginally too little for material, the amount and concentration of which happened to be underestimated. Status quo for the, often hidden, MvG risk is that assessment hereof is only very rarely included in the commercial contract stipulations.

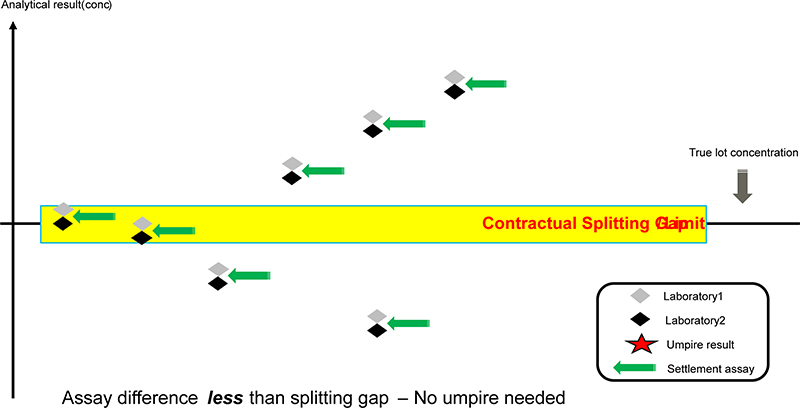

The current state of affairs is shown in Figures 3–4.

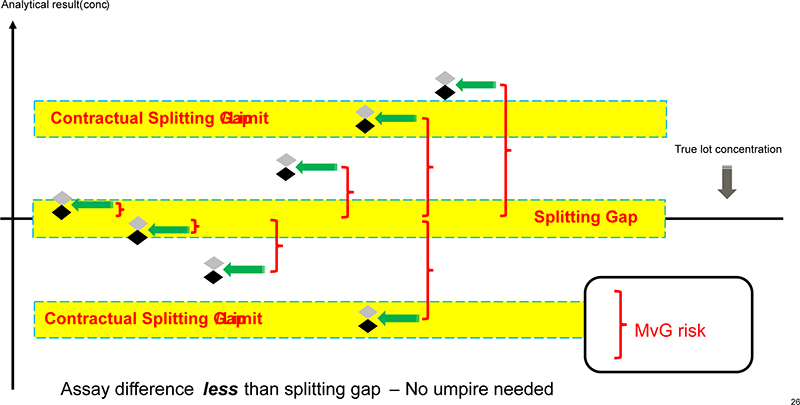

Figure 3. Functionality of assay exchange paradigm, the case of “no umpire needed”. Note the tacit assumption that the splitting gap is centred on the “true lot concentration”.

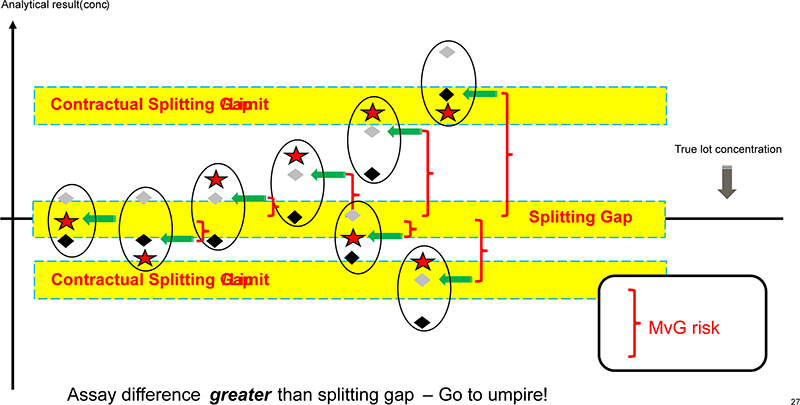

Figure 4. Functionality of assay exchange paradigm, the case of “go to umpire”, after which the middle assay will be the settlement value. Note the tacit assumption that the splitting gap is centred on the “true lot concentration”.

The elephant in the room is the tacit, unwarranted assumption that the contractual splitting gap is always centred on the true average lot concentration. Note for example in Figures 3 and 4 that an acceptable settlement assay is easily reached via the assay exchange scheme regardless of whichever general analytical level is bracketed by the interval spanning the three samples involved.

But this assumption is severely challenged by the fact that the crucial primary sample (which is immediately divided in three sub-samples) is in fact sampling a heterogeneous lot/materials.

But the reality is even more complex. The full scenario behind the assay exchange paradigm is shown in Figure 5, emphasising no less than two sampling operations, each with its own sampling/sub-sampling errors and uncertainties involved, all before analysis.

Figure 5. Assay Exchange reality—acknowledging two sampling stage uncertainty impacts: PSE, SSE (red arrows). PSE = Primary Sampling Error; SSE = Secondary Sub-sampling Error.

Following the TOS, when sampling heterogeneous materials (aggregate materials and mixtures, materials with significant grain-size contrasts …), there is every reason to take notice—and specially to take appropriate operational precautions—regarding the impact of the dominant primary lot sampling error (PSE).1–6 And there are equally serious reasons to take appropriate precautions regarding the subsequent “sample division” producing the three tacitly “assumed equal” samples for the seller, the buyer and umpire, for which there will be a secondary sub-sampling error (SSE). The latter may perhaps typically be smaller than PSE, but never neglectable, especially if suitable practical facilities to be used for appropriate comminution and mixing are not mandated in the contractual stipulations.

Assay Exchange paradigm: the grim reality

The degree to which is has been possible to reduce PSE will determine the general analytical concentration level in the primary lot sample, which, therefore, may differ from the “true lot concentration” to some, generally unknown degree. Appropriate precautions first and foremost include the TOS’ ability and success in eliminating the Incorrect Sampling Errors (ICS), which is the necessary condition for unbiased sampling.1–6 Similarly, regarding the subsequent sample preparation and division, ibid. Of these the primary sampling error (variance) will usually contribute with a dominating uncertainty contribution, but accidental residual heterogeneity within the primary sample may also contribute significantly with appreciable uncertainty contributions regarding “sample division”.

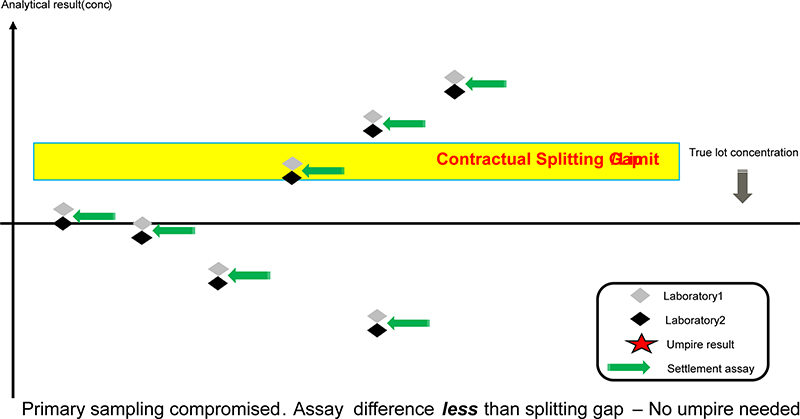

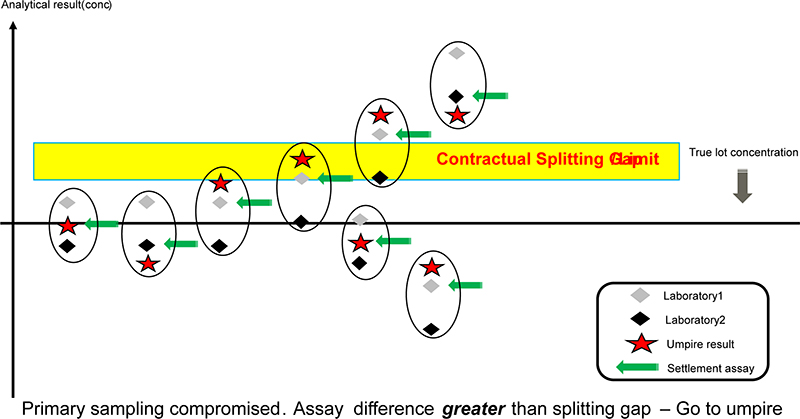

There is a logical order to these complementary influences, as follows. The degree of incomplete primary sampling bias elimination will lead to a random location of the splitting gap—which is manifested as a deviation from the assumed centring on the true lot concentration, as shown in Figure 6. This will be the situation regardless of whether the paradigm leads to “go to umpire” or not, Figures 6 and 7.

Figure 6. Same as Figure 3, now illustrating a realistic splitting gap location, which is random as a function of the degree of incomplete sampling bias elimination and other ISE deficiencies.

Figure 7. Same as Figure 4, now illustrating a realistic splitting gap location, which is random as a function of the degree of incomplete sampling bias elimination and other ICE deficiencies.

Mismatch vs Gap error (MvG)

A deviation between the settlement assay and the “true lot” concentration is termed the “Mismatch vs Gap” error, MvG. This uncertainty constitutes an economic risk, the MvG risk, which needs to be managed, which it manifestly is not a provision envisaged in the conventional assay exchange paradigm.

Adding in the sample division error (sub-sampling bias and/or variance), the relative disposition of the three analytical results cannot be ignored. The tripartite assay results from lab A, lab B and lab Umpire will depend on to which degree the primary within-sample heterogeneity has been successfully reduced/eliminated by appropriate TOS action before and during the practical sample division.

The full MvG risk can be illustrated with graphic clarity, Figures 8 and 9. Note that within the conventional assay exchange paradigm, the MvG uncertainty is tacitly always assumed to be zero, and its risk management need is, therefore, never on the business horizon.

Figure 8. Illustrating the MvG risk; case of no umpire needed. The MvG error/risk is only (close to) zero in the case of vanishing primary sampling uncertainty.

Figure 9. Illustrating the MvG risk; case of going to umpire. The MvG error/risk is only (close to) zero in the case of vanishing primary sampling uncertainty.

Figures 8 and 9 show that the location of the contractual splitting gap may be significantly displaced from the assumed closeness to the true lot concentration (location in the Y-axis direction), which is primarily caused by the degree of a primary sampling bias that has not been successfully mitigated. Note that the assay exchange scheme is followed regardless of this uncertainty, giving rise to potentially significant MvG errors—an uncertainty which is not acknowledged in the standard assay exchange paradigm. Is this deliberately overlooked? Ignored?

The point

The point to be made is that current assay exchange practices do not include mandatory means to deal with sampling influences in the splitting gap accounting scheme.

Thus, there will always be a real, non-vanishing risk of settling a business transaction based on the assay exchange paradigm at a level which may actually lie significantly distanced from the true metal lot content, a lot, Figures 8 and 9. The deviation, the MvG error/risk, may be small (low heterogeneity materials; acceptable sampling performance) or it may be large (significantly-to-excessively heterogeneous materials; non-representative sampling competence/equipment)—the point is that all this is studiously unknown to the contractual parties.

For many commodities, the economic risk involved may perhaps not constitute reasons for much worry (bulk commodities with relatively low unit value), but as tonnages go up, the sum-total economic effect may well still accrue to unacceptable amounts—while matters are always dramatically more serious for example for the precious metals industry concerning, e.g. Gold, Silver, Platinum, some REE and similar, where even small amounts of misassigned concentration results between buyer and seller translate into highly significant economic consequences. As an example, a misappropriation of 1 kg Gold represent a value of ~USD62,000; 1 kg for Platinum, ~USD33,775. Readers can do their own maths.

There appears to be some awareness of the issues delineated in this feature, for example:

Dave Murray, Asahi Refining (excerpt from): Deleterious Metals & Their Impact on Splitting Limits & Assay Exchanges for Gold Dore (Presentation at LBMA Conference 2021). “The splitting limit is the percentage band in which when comparing a client’s assay to the refiner’s the average of the two assays will be used as the basis of settlement. When outside this percentage band, a third analysis is performed by an independent umpire laboratory. Most often the splitting limit is contractually ‘negotiated’; almost becoming a commercial term. Maybe this is just based on historical contract traditions, or perceptions of risk with higher metal prices. Quite often there is very little consideration of ‘process capability’. Not always is there a lot of consideration given to the nature of the material being sampled and assayed”7

Awareness is good, but advice, recommendation and practical “what-to-do-about-it” tools are often missing. A comprehensive analysis of the TOS as a determining element in risk assessment and risk management was presented recently in which all necessary-and-sufficient actions to remedy the critical issues delineated above were presented: “Framing TOS in Risk Assessment”.8

Potential economic consequences

Because of omission of all sampling and sub-sampling variance influences in the assay exchange paradigm, there is a very big elephant in the room! Sampling errors and their effects (sampling bias and/or larger sampling variance than necessary) are overlooked in the conventional assay exchange accounting scheme. The economic consequences can be significant to severe, and always detrimental to at least one of the parties involved, but notably, never to the umpire institution or company—which is ok as the origin of the MvG risk is never with this entity anyway.

But the umpire costs can in fact be eliminated, see further below. Figures 8 and 9 shows with graphic clarity the principal non-zero magnitudes of the MvG risks under the ruling splitting gap assumptions. The magnitude of this unnecessary risk is never estimated, it is in fact rarely acknowledged and its economic consequences are, therefore, unknown, hidden from management.

The status quo is that the critical assay exchange paradigm ignores the MvG risk. It matters not that the economic value of this unmanaged risk may be small, because it may just as well be large—this is entirely a function of the managed, or unmanaged sampling errors, uncertainties and risks presented. Small effects may perhaps be wished-for in the status quo, but the real magnitude will forever be unknown, when studiously looking away…

However, there is a solution:

Universal resolution

One might perhaps worry that remedying the hidden MvG risk issues would entail a colossal effort—as checking for its magnitude at every commercial transaction would indeed be prohibitive.

However, all that is needed to resolve all these issues is remarkably much simpler!

The entire array of debilitating issues regarding the assay exchange scheme will conveniently go away if/when a mandatory statute is agreed upon by all parties only to use TOS-compliant representative sampling and sub-sampling procedures throughout the full lot-to-aliquot pathway. A one sentence mandate, to be included in every relevant trade contract going forward, will solve all problems:

Parting shot

Various suggestions are often given in defence of the assay exchange paradigm, for example: “Samples should regularly be sent for Round Robin (RR) assaying and comparison”.

To which: the findings of Round Robin comparisons, also called Proficiency Testing Programmes, are highly sensitive to whether the sample division process producing assumed “identical replicate samples” sent off to participating (and umpire laboratories) is indeed representative—or not. The Round Robin scheme is based on the premise that all primary samples are always divided into a seller—buyer—umpire tripartite set of scrupulously identical sub-samples (or into a series of individual Round Robin subsamples individually analysed by participating laboratories). If/when not enough, or no attention at all, is directed at the quality of the critical subsampling involved, the Round Robin scheme is subject to the exact same critique levelled above to the standard assay exchange paradigm. When no attention is directed to the sampling issues involved, the Round Robin facility is only able to compare the analytical performances alone, leaving the sub-sampling variance totally out of the comparison, effectively allowing a similar MvG risk.

Of course, good quality Round Robin organisers recognise that errors in subsampling may significantly influence the statistical study and the conclusions on performance of the participating laboratories in a certain testing programme. Therefore, Round Robin samples are often prepared to a much smaller particle size than what is the common for commercial settlement samples. The reasoning being that such final particle size will increase mixing efficiency and help reduce extraction errors, e.g. from smearing gold left behind on the pulverising instrument or by discarding oversize sample material that is too hard to crush. With Round Robin this “does not matter” as the aim is to compare analytical performances only. A Round Robin facility will sometimes perform homogeneity checks itself, to verify that each divided sample generates the same analytical result when analysed with its own in-house laboratory. Only after such vigorous measures have satisfied the Round Robin facility, will it send out the programme samples to participating laboratories. However, such proficiency testing samples have no longer a representativity relationship with the donor material they originated from; they have specifically been prepared to make the Round Robin exercise, or Proficiency Testing Programme, only focusing on the relative analytical performances; therefore, the Round Robin facility cannot validate the assay exchange paradigms. The Round Robin issues are identical to the assay exchange setup in that the accuracy w.r.t. the original lot composition will never be known. While this may be acceptable in the case in which one is really only interested in analytical performance comparison, this means that there is no saving grace w.r.t. the assay exchange paradigm: Round Robin checks will never be able to detect and to quantify the associated sub-sampling errors and their resulting uncertainties.

References

- K.H. Esbensen, Introduction to Theory and Practice of Sampling. IM Publications Open (2020). >https://doi.org/10.1255/978-1-906715-29-8

- F.F. Pitard, The Theory of Sampling and Sampling Practice, 3rd Edn. CRC Press (2019). ISBN: 978-1-138476486

- G.J. Lyman, Theory and Practice of Particulate Sampling – an Engineering Approach. Materials Sampling & Consulting (2019). ISBN: 9s78-1-646333820

- K.H. Esbensen and C. Wagner, “Theory of Sampling (TOS) versus measurement uncertainty (MU) – a call for integration”, Trends Anal. Chem. (TrAC) 57, 93–106 (2014). https://doi.org/10.1016/j.trac.2014.02.007

- P. Gy, Sampling for Analytical Purposes. Elsevier (1998).

- C.A. Ramsey, “Considerations for inference to decision units”, J. AOAC Int. 98(2), 288–294 (2015). https://doi. org/10.5740/jaoacint.14-292

- LBMA Assaying and Refining Conference 2021, 15–17 March 2021. https://www.lbma.org.uk/articles/lbma-assaying-and-refining-conference-2021

- (a) K.H. Esbensen and C. Paoletti, “Framing TOS in risk assessment: an outreach perspective for the future”, Spectrosc. Europe 34(8), 36–40 (2022). https://doi.org/10.1255/sew.2022.a26; (b) C. Paoletti and K.H. Esbensen, “Framing TOS in risk assessment: an outreach perspective for the future”, TOS Forum 11, 419–423 (2022). https://doi.org/10.1255/tosf.168; (c) https://wcsb10.com/recordingsof-the-wcsb10/ (Day 3/Session 9 (4 h:18 min:45 s).

Kim Esbensen

Kim H. Esbensen, PhD, Dr (hon), has been research professor in Geoscience Data Analysis and Sampling at GEUS, the National Geological Surveys of Denmark and Greenland (2010–2015), chemometrics & sampling professor at Aalborg University, Denmark (2001–2015), professor (Process Analytical Technologies) at Telemark Institute of Technology, Norway (1990–2000 and 2010–2015) and professeur associé, Université du Québec à Chicoutimi (2013–2016). From 2015 he phased out a more than 30-year academic career for a new quest as an independent researcher and consultant. But as he could not terminate his love for teaching, he is still very active as an international visiting, guest and affiliate professor. A geologist/geochemist/metallurgist/data analyst of training, he has been working 20+ years in the forefront of chemometrics, but since 2000 has devoted most of his scientific R&D to the theme of representative sampling of heterogeneous materials, processes and systems: Theory of Sampling (TOS), PAT (Process Analytical Technology) and chemometrics. He is a member of several scientific societies and has published over 250 peer-reviewed papers and is the author of a widely used textbook in Multivariate Data Analysis (35,000 copies), which was published in its 6th edition in 2018. He was chairman of the taskforce behind the world’s first horizontal (matrix-independent) sampling standard DS 3077 (2013). He is editor of the science magazine TOS forum and this Sampling Column. In 2020 he published the textbook: Introduction to the Theory and Practice of Sampling (impopen.com/sampling).  0000-0001-6622-5024

0000-0001-6622-5024

[email protected]

Aldwin Vogel

Duncan Aldwin Vogel is a global expert in weighing, sampling and testing of traded commodities. Already during his study in business management at the International School of Economics, Rotterdam, Aldwin started building his pedigree in the renowned family inspection business Hoff & Co. Services BV that became part of Bureau Veritas in 2010. From 2011 to 2013 Aldwin was based in Houston, USA for BV as acting Director, Steel and Energy Products. From 2013 to 2022 he was responsible for BV Commodities Global Service Line as Director Technical Governance. In 2022 Aldwin changed from the large corporate multinational to return to an agile family-owned organisation, to earning trust and keeping his international client focus as Regional General Manager Europe for Alfred H. Knight. Most recently in 2023 launching a TOS compliant SamplingHub for circular commodity: Incinerator Bottom Ashes.

His expertise covers all aspects of inspection, sampling and analysis starting from green field prospect requirements to fully implemented turn-key projects. Embracing the Theory of Sampling (TOS) to the fullest, augmented inspection services through IoT and smart communication, Aldwin recently also came out as inventor and patent holder of several novel inspection solutions. He is highly experienced at all aspects of testing for Transportable Moisture Limit and was leader of the TML workgroup of the TIC Council. He is a delegate of the Netherlands on ISO Technical Committee 102 (Iron ore and direct reduced iron) and TC183 (Copper, lead, zinc and nickel ores and concentrates) where his focus is on sampling, sample preparation, moisture determination and TML.  https://orcid.org/0000-0003-0445-5259

https://orcid.org/0000-0003-0445-5259

[email protected]